Our Mission

At Henman Performance Group, we are dedicated to helping those in the C-suite make decisions that create exceptional organizations—decisions leaders can’t afford to get wrong.

Leaders who choose to lead a team of top performers understand that these clever—often brilliant—individuals offer more, so they expect more in return. They want to work with other stars in a culture that fosters their growth, formulates a clear strategy for their success, and creates the day-to-day processes that allow them to achieve their personal goals.

At Henman Performance Group, we help clients make decisions that will enable them to lead exceptional organizations—agile yet stable companies—that hold on to their core values while responding adeptly to the temporary nature of the global economy.

Leaders who choose to lead a team of top performers need to understand that these clever—often brilliant—individuals offer more, so they expect more in return. They want to work with other top performers in a culture that fosters their growth, formulates a clear strategy for their success, and then creates the day-to-day processes that allow them to achieve their personal goals.

At Henman Performance Group, we can help you make the decisions that will enable you to lead exceptional organizations—agile yet stable companies—that hold on to their core values while responding adeptly to the temporary nature of the global economy.

About Linda Henman PhD

Dr. Linda Henman, the Decision Catalyst ®, is one of those rare experts who advises, speaks, writes, and coaches. As the founder of Henman Performance Group, a leadership consulting firm located in St. Louis, MO, Linda helps C-suite leaders make decisions that they must get right and can’t afford to get wrong. In more than 40 years, none of her projects has failed. Some of her clients include leaders in organizations like Avon, Emerson Electric, Estee Lauder, Kraft, and Tyson Foods.

Linda first studied decision-making while working on her Ph.D. in 1994. She conducted long-term original research on138 American POWs (including John McCain) who had survived five or more years of brutal imprisonment. The study, under the direction of the U. S. Navy, uncovered the pivotal decisions the POWs made to stay resilient—decisions about their beliefs, identity, and life’s purpose. These research findings have guided Linda’s work with executives ever since.

Today, Linda works predominately with business owners and those in the c-suite to help them make decisions on issues like increasing profitability, mergers & acquisitions, and succession planning. (In fact, Linda was one of eight succession planning experts who worked with John Tyson after his company’s acquisition of International Beef Products—one of the most successful acquisitions of the 21st Century.)

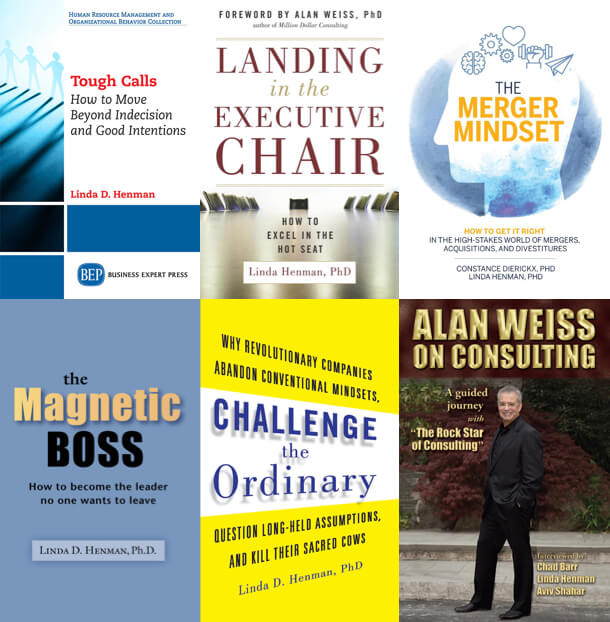

Linda has written or cowritten eleven books:

- Healthy Decisions

- Honorable Returns

- The Vibrant Board

- Risky Business: Why Leaders Must Develop a Disruptive Mindset

- The Merger Mindset: How to Get it Right in the High-Stakes World of Mergers, Acquisitions, and Divestitures

- Tough Calls: How to Move Beyond Indecision and Good Intentions.

- Challenge the Ordinary

- Landing in the Executive Chair: How to Excel in the Hot Seat

- The Magnetic Boss: How to Become the Leader No One Wants to Leave

Linda is a member of the National Speakers’ Association, Million Dollar Consultants’ Hall of Fame, which has only 50 members worldwide; and she holds numerous professional certifications, including Director of Professionalism, a designation given by the National Association of Corporate Directions.

She lives in St. Louis, MO

About Deborah Perkins

After more than forty years in hospital administration, Deborah Perkins joined Henman Performance Group to provide leading-edge financial and operational consulting for hospitals, healthcare institutions, and all providers of patient care. For more than 4 decades she worked with large hospital chains like Banner Medical Health System in Arizona, University of Maryland Medical System, and smaller hospitals in the Midwest like Franklin Hospital in Benton, Illinoi, resulting in millions of dollars of cost-saving changes.

Debbie’s expertise equips her to make sure documentation is correct so that her clients receive the payments they deserve. That means she quickly identifies both revenue growth opportunities and reimbursement threats. As a trusted advisor, Debbie helps hospital executives make decisions about margin improvement, revenue cycle management, case mix, denials, and physician and patient satisfaction. By assisting CEOs in developing strategies to maximize revenue, her clients have been able to optimize clinical documentation and coding practices.

Debbie received a Bachelor of Science degree in Business Education from Southern Illinois University at Carbondale, a Bachelor of Arts in Health Information Administration from Hillcrest Medical Center in Tulsa, where she also qualified for the Registered Health Information Administration (RHIA) certification, and an MBA from Pepperdine. She holds the designation of Fellow in the American College of Healthcare Executives and the American Health Information Management Association. She is also a Certified Professional in Healthcare Quality.

Her track record demonstrates her commitment to empowering hospital executives to achieve their boldest vision through dramatic strategies. Her processes and procedures provide a framework for uncovering every cost-saving opportunity, thereby improving the financial health of the hospital so it can continue to offer exceptional patient care.

Typical Client Results

Operational Effectiveness

Situation

A small, 100-bed hospital in Wisconsin contacted us because they had been experiencing financial difficulties and had a “gut” feeling reimbursement practices were the culprit. They were right, but that wasn’t their only problem. Our initial examination of their records and interviews with key individuals indicated they were losing money because of several major issues: reimbursement practices, case mix, a low clean-claim rate, flawed communication between physicians and coding staff, lack of education, and the failure to make physicians strategic partners in decision making. We knew they were leaving at least a million dollars on the table annually but suspected things were worse than that.

Intervention

By implementing our proprietary “First Look” program, we identified the most salient factors that had been creating roadblocks to the hospital’s financial success. Working together, we assessed the hospital’s leadership, current revenue cycle process, education of coders, communication patterns, and opportunities for growth. Specifically, we examined, developed, and affected change in the following areas:

- Case-mix index versus services provided

- Current revenues

- Clinical documentation

- Communication with physicians

- Ongoing education with coders with an emphasis on audit results

- Effective CDI programs/education

- Revenue Integrity programs/analysis to include evaluation of both inpatient and outpatient coding/auditing

- Evaluation and Management (E&M).

- Monthly scorecards of KPI for physician and hospital leadership

- Systems for workflows and processes specifically related to Revenue Cycle programs and reimbursement

Resolution

The objective was to find at least $1M; but we substantially surpassed that number. In six months, we were able to add $3.5 M immediately to their revenue stream; and by teaching both executives and employees how to use our best practices, we ensured the financial health of the hospital into perpetuity. In general, we assisted the CEO and CFO in developing strategies for “not leaving money on the table.” Specifically, we did the following:

- Improved incomplete clinical documentation

- Reduced denials

- Better managed revenue cycles

- Improved relationship between administrators and physicians

- Implemented effective CDI programs/education.

In general, we helped them make critical decisions that they couldn’t afford to get wrong.

Mergers and Acquisition:

Situation: In a 2001 $3.2 billion deal, the American poultry giant Tyson Foods, acquired beef and pork producer International Beef Products to form the largest US meat company in the world. The transaction resulted in the combined company selling approximately 28 per cent of the beef, 25 per cent of the chicken, and 18 per cent of the pork in the United States, making it the largest protein producer on the planet. Linda was one of only eight people who worked directly with John Tyson on this successful merger of Tyson Foods and IBP.

Intervention: As he indicated in the Harvard Business Review account, John Tysons’ efforts to produce a talent pipeline had not supplied enough quality leaders. In 2002 he formed a senior executive task force that included himself, his direct reports, and eight succession-planning experts. We mapped out a leadership development system, ensured objectivity in assessment, and facilitated buy in. We made recommendations to John Tyson and his leadership team about the best candidates for key positions and then offered coaching and training to help them develop in their new roles

Resolution: The task force ensured that promising leaders had opportunities to become well-versed in all aspects of the company’s business and helped shift accountability for succession planning and leadership development to John Tyson’s direct reports and those in their chain of command. Additionally, after our intervention, the stock price rose more than 50%,, making it one of the most successful M & A deals of the 21st Century.

CEO Selection

Situation: A $1.5B manufacturing company acquired another, smaller company that produced a similar line of products. The CEO of the target company was nearing retirement age, and performance, growth, and stock prices had stagnated. The board of directors began a search for a new CEO, one that could put the newly formed organization on an aggressive growth path. Once the search committee had identified two possible candidates, the chairman asked Linda to assess the two finalists.

Intervention: Through a proprietary process that is unique to Henman Performance Group,, Linda interviewed the final two candidates and assessed each on strategic thinking, quantitative abilities, learning capacity, people skills, and business-related personality measures. She determined the better of the two candidates (the other was subsequently hired by another firm and fired six months later). Linda coached the new CEO for the first six months of his tenure, assessed his entire executive team, and delivered a succession plan that ensured the continuity of leadership. A year later she conducted a board evaluation of the new CEO, which indicated strong approval from the directors and board chair.

Resolution: Because we have the capacity to assess beyond past performance to determine the strategic success of a new leader, within the first year of the new CEO’s leadership, the stock price tripled. After that, he expanded international operations by orchestrating four major acquisitions in Asia, Europe, and the US. The client reported an improvement in hiring and development, which ultimately influenced millions of dollars. The chairman of the search committee commented: “Dr. Henman was instrumental in the successful selection of an outstanding CEO for our NYSE organization. Within a matter of months, this individual dramatically impacted our market capitalization while also positioning this global enterprise for enhanced levels of growth and profitability. Her insights and guidance were extremely valuable and critical to our success.”

When he joined the company in 2005, John made $4.8 M. In 2019, when he served as President, Chief Executive Officer, and Chairman, his total compensation had risen to approximately $7.5M. In 2024, GuruFocus, a financial website and investment research platform, extimates his net worth to be at least $24 Million. John make the company succeed, so he succeeded too.

Succession Planning

Situation: The general manager of a $500M Midwest manufacturing facility started resting on his laurels. Although the company produced at a rate comparable to most others in the industry, the CEO knew it could do better. Most of the employees were “good citizens” who showed up to work and did an average job, but the general manager didn’t push for much beyond that.

Intervention: To support the CEO’s goal for each manager to identify two replacements for his or her position, the leadership hired us to develop a succession plan for those who had been identified as high potentials. We assessed high potentials beyond past performance to determine their future success, and then, using a four-point scale, made recommendations to the company about whether each should be promoted and how quickly the person should progress.We then gave participants feedback about their results, coached each person, and developed an action plan that included options for development.

Resolution: After we completed the succession planning phase and identified the gaps in the talent pipeline, the CEO determined he needed to replace the general manager and CFO and restructure the business. With our help, they hired exceptional people who put the company back on track and kept it from slipping into the low-productivity realm in which most other manufacturing companies have found themselves. .

In our ten-year tenure with the company, the market capitalization rose from $1.7B to $3.15B, and stock prices tripled.

Through our effective succession planning efforts, we influenced the dramatic growth of this company and ensured its solid footing..

Strategic Growth

Situation: After the integration of three companies, an East Coast manufacturing organization continued to lose market share, even in a good economy. The CEO determined the company’s president needed to be replaced and a new strategy formulated. They lacked a clear mission statement or vision for the next five years, even though a global vision to double the business in the next 3-5 years existed.

Intervention: Linda assessed several candidates for the president’s position and recommended a top performer for the role. He, in turn, hired us to select his new CFO and COO. Once the new leaders were in place, we met with the new team to set their strategy. Working together, we analyzed the company’s current tactics and strategies, examined its driving forces, evaluated the current allocation of resources, explored opportunities for growth, and pinpointed their competitive advantage relative to their top three competitors. We identified the five major strategic objectives for the year, and each member of the leadership team took responsibility for driving a specific goal. We coached the president and each member of the leadership team individually following the strategy formulation meetings.

Resolution: The reorganization of their product lines effectively completed the integration of the three companies. Along with the launch of a simplified product portfolio, the company began plans for targeting vertical markets to help their customers select the best product for their specific needs. Even though the good economy quickly soured, this company remained vibrant while their competitors lost market share.

Client List

Construction:

Alberici Enterprises

Builders Bloc

McBride & Sons Building

McCarthy Building Companies

Neland Investment Management

PayneCrest Electric

Vantage Homes

Convenience Store Industry:

British Petroleum

Equiva Service

Shell Oil Company

On the Run

Wallis Companies

White Hen Restaurants

Food Industry:

Coors Brewing Company

Elan Nutrition

Kraft Foods

Hautly Cheese

Nestle USA, Inc.

Raskas Cream Cheese

Southern Products

Tyson Foods

Medical:

Banner Medical Health Center

Barnes Jewish Hospital

Clinical Laboratory Management Association

Franklin Hospital

Ranken Jordan Pediatric Hospital

SSM Home Care

St. John’s Mercy Medical Center

University of Maryland Medical System

Manufacturing/Technology

Belden

Boeing Aircraft

Brooks Instruments

Emerson Electric

Fisher Controls International, Inc

Harbison Corporation

Liebert Corporation

In-Sink-Erator

Schroeder & Treymane

The Trane Company

Western Forge

Government/Military:

POW Research Center

TOPGUN (Navy Fighter Weapons School)

USDA Rural Development

US Air Force, Tactical Air Command

Retail:

Avon Products, Inc.

Belk Store Services

Echo Design

Estee Lauder Companies, Inc.

Finlay Fine Jewelry

Newspace

Price Chopper

St. Louis Music Supply Co.

Saks, Inc.

Financial Services:

AG Edwards

Arthur Andersen

Edward Jones

Merrill Lynch

RGB & Co.

Virtus Investment Partners

Services:

Ameren UE

AT & T

Environmental Industries

Insurance:

Blue Cross Blue Shield

Chartered Property Casualty Underwriter

GenAmerica Corporation

Growing Family

Hortica Insurance

Progressive Insurance

Reinsurance Group of America

Hospitality:

Drury Inns

Marriott Hotels

Renaissance Hotels

Academia:

Ranken Technical College

St. Louis University

Washington University

Webster University